Finance

The Ultimate Guide to Chrysler Capital Financing Solutions

Finance

Digitale Munteenheid (Digital Currency): A Complete Guide

In recent years, digital currencies have emerged as a revolutionary innovation in the global financial landscape. Also referred to as “digitale munteenheid” in Dutch, digital currencies represent a digital form of money that is designed to function as a medium of exchange, just like traditional currencies.

However, unlike physical money (cash), digital currencies exist only in digital form and are typically transferred electronically. As we move further into the digital age, the role of digital currencies continues to expand, influencing how businesses, governments, and individuals engage with financial systems. This article explores what digital currencies are, how they work, their advantages and disadvantages, and their potential to reshape global finance.

What Is Digitale Munteenheid (Digital Currency)?

Digital currency refers to any form of currency that exists solely in digital or electronic form. Unlike traditional fiat currencies such as the dollar, euro, or yen, which are issued by governments and stored in physical form (notes and coins), digital currencies are intangible. They can be stored on digital wallets and transferred via online networks.

Types of Digitale Munteenheid (Digital Currencies)

- Cryptocurrencies: These are decentralized digital currencies, powered by blockchain technology. Bitcoin, Ethereum, and Litecoin are prominent examples. Cryptocurrencies are not controlled by any central authority and use cryptography for secure transactions.

- Central Bank Digital Currencies (CBDCs): Governments and central banks are exploring the idea of creating their digital currencies, backed by the state. Examples include China’s digital yuan and Sweden’s e-krona.

- Virtual Currencies: These are digital currencies typically used within specific ecosystems, such as online gaming platforms or virtual worlds. They often have no value outside their respective platforms.

- Stablecoins: A form of cryptocurrency designed to minimize volatility by being pegged to a stable asset, such as a fiat currency (e.g., Tether) or commodities like gold.

How Digital Currencies Work

Digital currencies operate through a combination of digital wallets, cryptography, and a network of computers that ensure the secure transfer of value. Here’s how a typical transaction works:

- Digital Wallet: Users store their digital currencies in digital wallets, which can be software-based (on a computer or smartphone) or hardware-based (physical devices designed to store digital currency securely).

- Blockchain: Most digital currencies, particularly cryptocurrencies, use blockchain technology—a decentralized ledger that records all transactions across a network of computers. Blockchain ensures transparency, security, and immutability of transaction records.

- Public and Private Keys: To transfer digital currency, users need a public key (similar to a bank account number) and a private key (a password that gives access to the currency). The transaction is verified and added to the blockchain by miners or validators, depending on the consensus mechanism.

- Decentralization: Many digital currencies, especially cryptocurrencies, are decentralized, meaning they are not controlled by a single entity (like a government or bank). Instead, they rely on peer-to-peer networks.

The Advantages of Digital Currencies

- Speed and Efficiency: Digital currencies allow for nearly instant transactions, eliminating the need for intermediaries such as banks. This can be particularly beneficial for cross-border payments, which traditionally take days to process.

- Lower Transaction Costs: Since digital currencies cut out intermediaries, they often come with lower transaction fees, making them an attractive option for businesses and consumers alike.

- Accessibility: Digital currencies provide financial access to those who may not have access to traditional banking systems, such as individuals in developing countries or those without a credit history.

- Security: Cryptocurrencies, in particular, use advanced cryptographic techniques to secure transactions, reducing the risk of fraud or theft.

- Transparency: Blockchain technology ensures that all transactions are recorded and can be viewed by anyone on the network, fostering transparency.

- Decentralization: The lack of a central authority means that digital currencies cannot be manipulated by governments or central banks, making them an attractive option for people who distrust traditional financial systems.

The Challenges of Digitale Munteenheid “Digital Currencies”

- Volatility: Cryptocurrencies are notorious for their price volatility. For instance, Bitcoin’s value has seen massive fluctuations over the years, making it a risky asset for investment and use as a currency.

- Regulation: The legal and regulatory framework for digital currencies is still evolving. Different countries have different stances on digital currencies, and this creates uncertainty for businesses and users. Some countries have banned cryptocurrencies outright, while others are cautiously embracing them.

- Security Risks: Despite the strong cryptographic security, digital currencies are not immune to hacking. High-profile incidents of exchanges being hacked have resulted in significant financial losses.

- Adoption Barriers: For digital currencies to become widely adopted, both consumers and businesses need to feel comfortable using them. As of now, many people are unfamiliar with how digital currencies work, creating a barrier to widespread adoption.

- Energy Consumption: The process of mining cryptocurrencies, particularly Bitcoin, requires enormous amounts of computational power and energy, leading to concerns about its environmental impact.

Central Bank Digital Currencies (CBDCs)

One of the most intriguing developments in the digital currency space is the rise of Central Bank Digital Currencies (CBDCs). Unlike cryptocurrencies, CBDCs are issued and controlled by central banks. The idea behind CBDCs is to combine the benefits of digital currencies (speed, efficiency, and accessibility) with the stability and backing of traditional fiat currencies.

Key Features of CBDCs

- Government-Backed: CBDCs are supported by central banks, ensuring stability and trust in their value.

- Digital Payment System: CBDCs would work alongside existing fiat currency systems, offering consumers another option for transactions.

- Financial Inclusion: CBDCs could provide financial access to underserved populations, particularly in countries where banking infrastructure is lacking.

Countries like China, Sweden, and the Bahamas have already begun experimenting with their versions of CBDCs, and it is likely that more nations will follow suit.

The Future of Digitale Munteenheid “Digital Currency”

The future of digital currencies is filled with both promise and uncertainty. As technology evolves, so too will the ways in which we use and perceive money. Here are some potential developments to look out for:

- Widespread Adoption of Cryptocurrencies: As education and awareness grow, cryptocurrencies could see wider use in everyday transactions. Businesses that accept Bitcoin, Ethereum, and other cryptocurrencies as payment are already becoming more common.

- More CBDCs: The continued development of CBDCs will play a significant role in shaping the future of money. Governments will likely focus on creating secure and user-friendly digital currencies that coexist with traditional financial systems.

- Stablecoins as a Solution: Stablecoins, with their reduced volatility, may become a preferred method for online transactions and cross-border payments, providing a bridge between traditional finance and the crypto world.

- Regulatory Clarity: As governments around the world work to develop regulations for digital currencies, the legal landscape will become clearer, potentially fostering more innovation and adoption.

- Technological Innovations: Future advancements in blockchain, cryptography, and financial technology could lead to the creation of more efficient and secure digital currencies.

Conclusion

Digitale Munteenheid “Digital currencies” are reshaping the global financial system, offering new opportunities and challenges. From cryptocurrencies like Bitcoin to Central Bank Digital Currencies, digital money is gradually becoming a significant part of the economic fabric. As more people, businesses, and governments embrace this new form of currency, we can expect ongoing innovation, debates around regulation, and shifts in how we understand and use money. Whether they are a temporary trend or a lasting evolution, digital currencies have undoubtedly marked the beginning of a new era in finance.

Business

Money6x.com: Your Guide to Financial Growth and Stability

Business

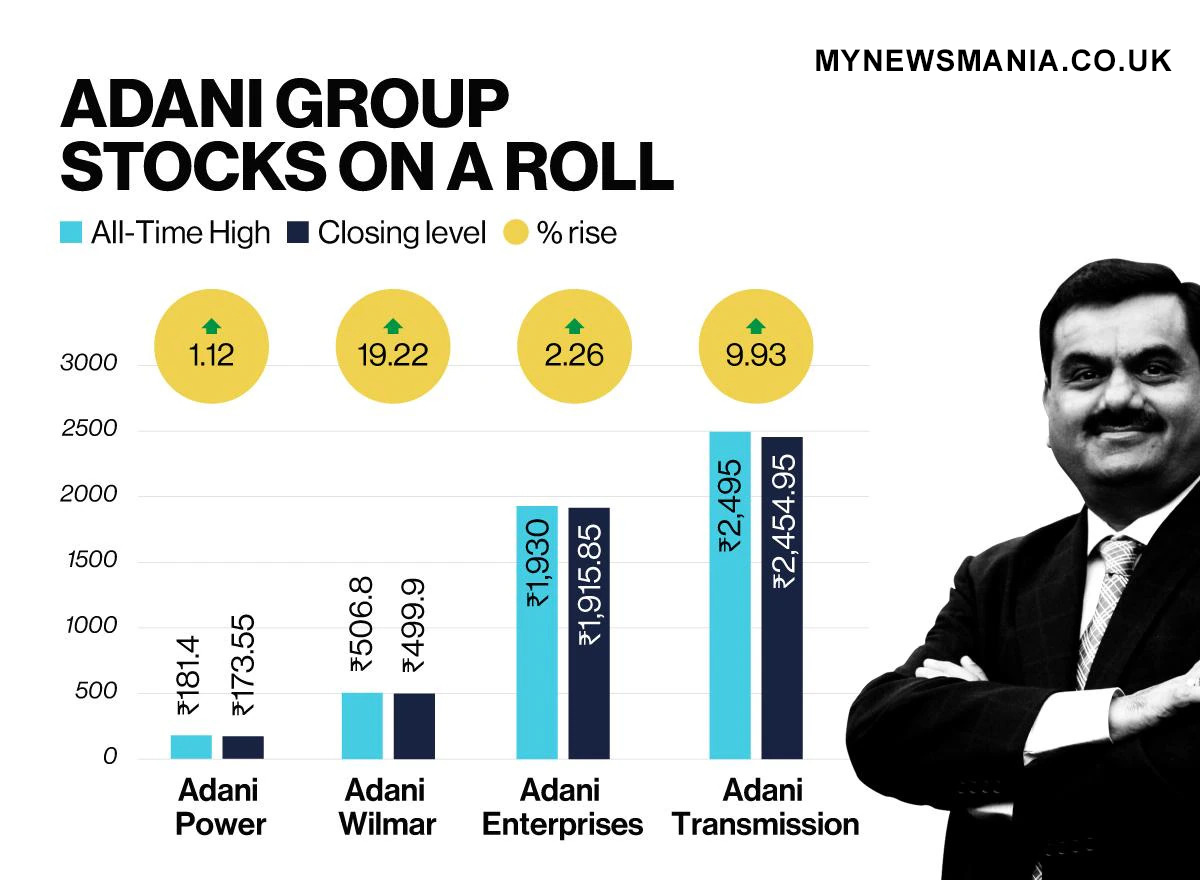

Adani Share Price: A Detailed Overview

This article comprehensively analyzes Adani share price, focusing on recent trends, key factors influencing its movement, and what investors might expect shortly.

Under the leadership of billionaire Gautam Adani, the Adani Group has expanded to become one of the most significant conglomerates in India, with operations in energy, resources, logistics, and more. The market value of Adani firms’ shares, particularly those of Adani Enterprises, Adani Ports, and Adani Green Energy, has attracted the interest of investors worldwide as well as in India. Because of the way Adani’s firms affect both the Indian economy and the larger global markets, the stock market performance of these companies is keenly monitored.

Overview of Adani Group’s Stock Market Presence

Adani Group Companies on the Stock Market

The Adani Group comprises several publicly traded companies, each with its own focus and market dynamics:

- Adani Enterprises: The flagship company is involved in various industries, including coal mining, power generation, and infrastructure.

- Adani Ports and SEZ: A significant port management and logistics player crucial for India’s trade.

- Adani Green Energy: Focuses on renewable energy projects, including solar and wind power.

- Adani Transmission: This company specializes in power transmission and distribution.

- Adani Power: One of India’s largest private thermal power producers.

- Adani Total Gas: Focused on gas distribution, including piped and compressed natural gas.

Different factors influence each company’s share price, but it tends to move with broader trends in the Adani Group.

Historical Performance of Adani Shares

The Adani Group’s share prices have seen remarkable growth over the past decade, often outperforming the broader market indices. Here are some key points:

- Long-Term Growth: Over the last few years, Adani shares have shown upward solid momentum, particularly in 2020 and 2021, when several of the group’s stocks witnessed multi-fold increases.

- Volatility: The rapid price increases have also been accompanied by periods of high volatility, often due to market speculation, global economic conditions, and regulatory scrutiny.

- Market Capitalization: The rising share prices have propelled Adani companies into the top tier of Indian market capitalization rankings, with several frequently listed among the top 10 in the country.

Factors Influencing Adani Share Price

Expansion and Diversification

Adani’s share price has grown significantly due to its aggressive strategy of venturing into new markets and industries, such as renewable energy and worldwide expansion. These actions have been well received by investors, who view them as long-term growth prospects.

Regulatory and Political Environment

The Adani Group operates in highly regulated industries like mining, infrastructure, and energy. Changes in international trade ties, environmental restrictions, or government policies can significantly impact the share values of Adani firms.

Market Sentiment and Speculation

Like many big corporations, Adani’s stock values are frequently impacted by market mood. Quarterly solid results or introducing a new project are positive news that might cause prices to rise quickly. On the other hand, bad news, such as claims of financial wrongdoing or regulatory violations, might cause rapid falls.

Global Economic Conditions

Global economic developments, notably commodity pricing, trade regulations, and the need for energy worldwide, also impact Adani enterprises. For example, Adani Enterprises and Adani Power’s profits may be directly affected by changes in the price of coal and oil. Still, Adani Green Energy may benefit from increased demand for renewable energy worldwide.

Recent Trends in Adani Share Price

Performance in 2023-2024

- Adani Enterprises: Continued to lead the pack with steady growth, backed by solid project pipelines and expansion into new markets.

- Adani Green Energy: Benefited from the global shift towards renewable energy, with its share price reflecting investor confidence in the future of green energy.

- Adani Ports: Saw fluctuations based on global trade volumes and domestic port traffic, with a generally upward trend as India’s trade dynamics improved.

Impact of the Hindenburg Report

Early in 2023, a study by Hindenburg Research that claimed the Adani Group had engaged in accounting fraud and stock manipulation caused great controversy. As a result, all of the Adani companies’ share values fell precipitously, wiping off billions of market value.

But because of intelligent reactions to the accusations, ongoing project execution, and investor faith in the group’s businesses’ long-term sustainability, the firm has regained a significant portion of its losses.

What to Expect in the Future Adani share price

Continued Growth in Renewable Energy

Adani Green Energy is anticipated to maintain its current growth trajectory as the global community and India move towards greener energy sources. The company is a crucial stock because of its lofty goals and the government’s backing for renewable energy projects.

Infrastructure Development

India’s continued infrastructure development, especially in logistics and transportation, will probably be advantageous for Adani Ports and Adani Enterprises. As the Indian economy expands, these businesses should continue to witness revenue growth and share price appreciation.

Market Volatility

Adani share price are likely to remain volatile, which is to be expected given the group’s exposure to both regulatory risks and international economic conditions. Long-term investors still have a good chance of earning sizable returns, though.

Conclusion

Adani group’s prices reflect the group’s aggressive growth objectives, market positioning, and overall economic Adani. Although equities have seen considerable volatility, investors have nonetheless received sizable gains from them. Domestic and foreign investors are anticipated to continue paying close attention to the Adani Group’s shares and entering new markets and industries.

Investors in Adani corporations must stay current with the most recent advancements, regulatory modifications, and market trends. With thorough research and an eye toward the future, Purchasing Adani stock is lucrative.

-

News5 months ago

News5 months agoBrooke Tilli – Bio, Age, Relationships, Career, Net Worth, and Boyfriend

-

Celebrity4 months ago

Celebrity4 months agoPedro Vaz Paulo: A Life of Redemption

-

Celebrity4 months ago

Celebrity4 months agoBurak Deniz: The Turkish Heart-Throb

-

Tech5 months ago

Tech5 months agoCloud Computing: Enabling IT Innovation

-

News5 months ago

News5 months agoDefine a Offshore Accident Lawyer

-

Tech4 months ago

Tech4 months agoSaaS Integration: Cloud-Based Software

-

Business4 months ago

Business4 months agoJanitor AI: Future of Auto Maintenance

-

News5 months ago

News5 months agoAI Deepfake Threaten to Global Elections. No One Can Stop Them.